Analysis of GBP/USD 5M

The GBP/USD currency pair collapsed on Thursday from the start of the European trading session. While there could be endless discussions about why the pound crashed on Thursday, we would first remind you of the obvious: the British pound had been rising for too long, too strongly, and without much justification. Therefore, even without any fundamental or macroeconomic reasons, it should fall for a long time and significantly. However, this week, nearly all factors supported the U.S. dollar. In addition to all the macroeconomic data from across the ocean and Jerome Powell's speech on Monday, there was a speech by Andrew Bailey, who hinted at the potential acceleration of the pace of monetary policy easing. Moreover, on Thursday, the UK's services PMI was weaker than expected, while the U.S. ISM services index came in much stronger. In any case, the British currency remains highly overbought.

From a technical standpoint, the upward trend has been broken, so the pound could continue falling for an extended period. One only needs to look at the daily and weekly time frames to understand that the pound still has room to fall. It is plummeting in a freefall mode without any corrections. In this, we also see a form of ultimate justice. For months, we've been saying the same thing — there are no grounds for the pound to rise, but what else can it do when the market (big players) keeps buying it? However, the factor of the Federal Reserve's monetary policy easing may have already been fully priced in.

At the start of the European trading session, a good sell signal was formed near 1.3222. Subsequently, the price continued forming sell signals at each successive level. Around the 1.3175 level, there was a brief pause, but the movement resumed shortly after.

COT Report:

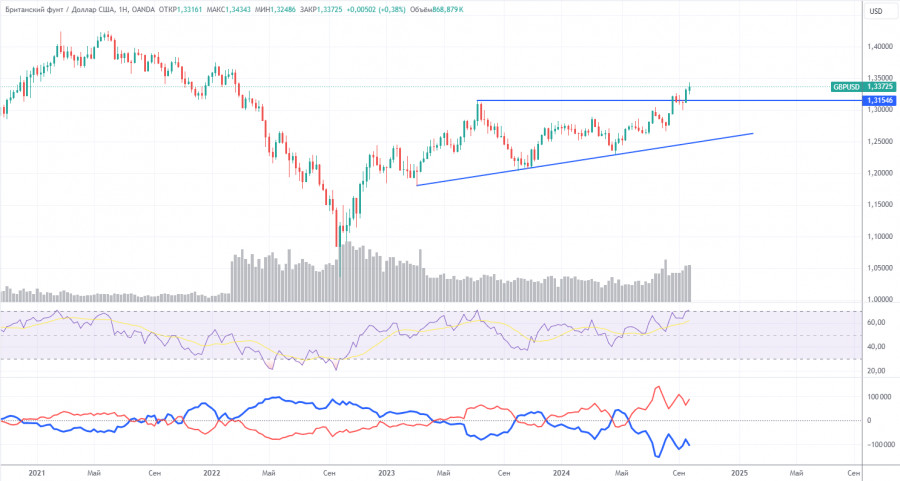

The COT reports for the British pound show that commercial traders' sentiment has been constantly changing over recent years. The red and blue lines, representing the net positions of commercial and non-commercial traders, frequently intersect and are mainly near the zero mark. We also see that the last phase of the downtrend occurred when the red line was below the zero mark. The red line is above zero, and the price has broken through the important level of 1.3154.

According to the latest report on the British pound, the non-commercial group opened 30,500 BUY contracts and 6,500 SELL contracts. Thus, the net position of non-commercial traders increased by 24,000 contracts over the week. Market participants continue to buy up the pound sterling.

The fundamental backdrop still provides no basis for long-term purchases of the pound sterling, and the currency itself has a genuine chance of resuming a global downtrend. However, on the weekly time frame, an ascending trendline has formed, so until it is broken, we cannot expect the pound to fall in the long term. The pound sterling is rising against almost all odds, and even when COT reports show that major players are selling the pound, it continues to grow. The CCI indicator has already entered the overbought area, even on the weekly time frame.

Analysis of GBP/USD 1H

The GBP/USD pair continues to decline firmly in the hourly time frame. The upward trend has been canceled, and now only a strong and prolonged fall of the British currency should be expected. Of course, the market may still resume unjustified purchases of the pound, but once again, let us remind you—that there are no fundamental or macroeconomic grounds for this. Therefore, as before, we support only the downward movement.

For October 4, we highlight the following important levels: 1.2796-1.2816, 1.2863, 1.2981-1.2987, 1.3050, 1.3119, 1.3175, 1.3222, 1.3273, 1.3367, 1.3439. The Senkou Span B lines (1.3288) and Kijun-sen (1.3258) can also serve as signal sources. Setting a Stop Loss to breakeven when the price moves 20 pips in the intended direction is recommended. The Ichimoku indicator lines may shift throughout the day, which should be considered when determining trading signals.

No significant events are scheduled in the UK for Friday, but the NonFarm Payrolls and unemployment reports will be released in the U.S. If the figures come in weaker than expected, these reports could easily trigger a 100-pip drop in the dollar. However, dollar strengthening remains more likely since the downtrend has already begun.

Explanation of Illustrations:

Support and resistance levels: thick red lines where price movement may end. They are not sources of trading signals.

Kijun-sen and Senkou Span B lines: lines of the Ichimoku indicator transferred to the hourly time frame from the 4-hour chart. These are strong lines.

Extreme levels: thin red lines from which the price has previously bounced. They serve as sources of trading signals.

Yellow lines: trend lines, trend channels, and other technical patterns.

Indicator 1 on the COT charts: shows the net position size of each trader category.