GBP/USD 5M

The GBP/USD currency pair did not show anything interesting on Thursday. An incomprehensible movement was observed all day, which is difficult to classify like a flat, but you can't call it a trend either. Traders ignored the Ichimoku indicator lines, which is not surprising, since we have a pronounced flat at the timeframe. Or a "swing." One way or another, but when the price moves mainly to the side, there is no need to talk about good movements or good signals. Moreover, not a single significant macroeconomic report was published during the day. Therefore, the volatility was low. Thus, it is not possible to make any high-profile conclusions. You need to wait for the pair to leave the horizontal channel or trade from its borders to the rebound.

There were few trading signals on Thursday, but they were all extremely inaccurate. This is also not surprising, since all of them were formed near the critical line, which is not a good source of trading signals in the flat, which we already talked about in past articles. As a result, all signals except the latter were false. It was possible to try only the first two, and even if you ignored our recommendations about being cautious when opening positions. Because even the first signal showed that the market does not know what to do with the pair. It is impossible to understand what it was: a rebound from the Kijun-Sen line or its breakthrough. Therefore, it was better to bypass this signal. The second signal for short positions led to a fall at 17 points, which was not enough to put Stop Loss to breakeven.

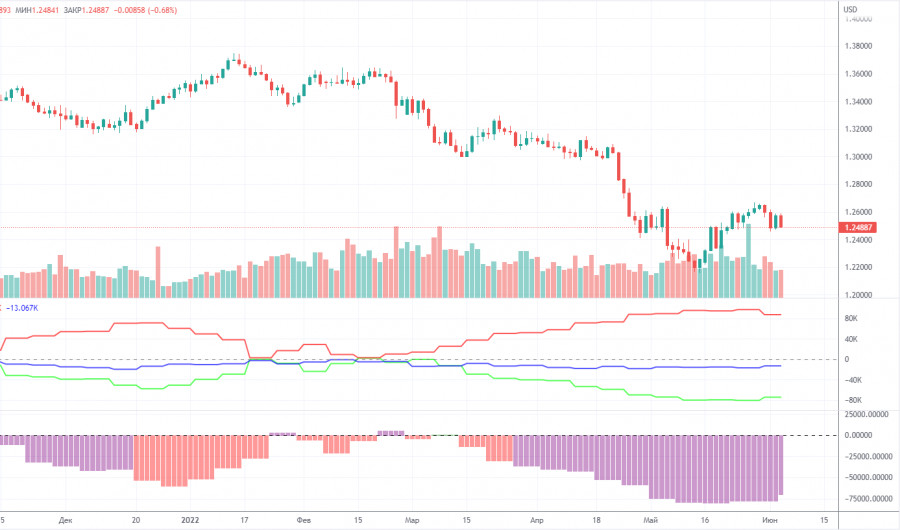

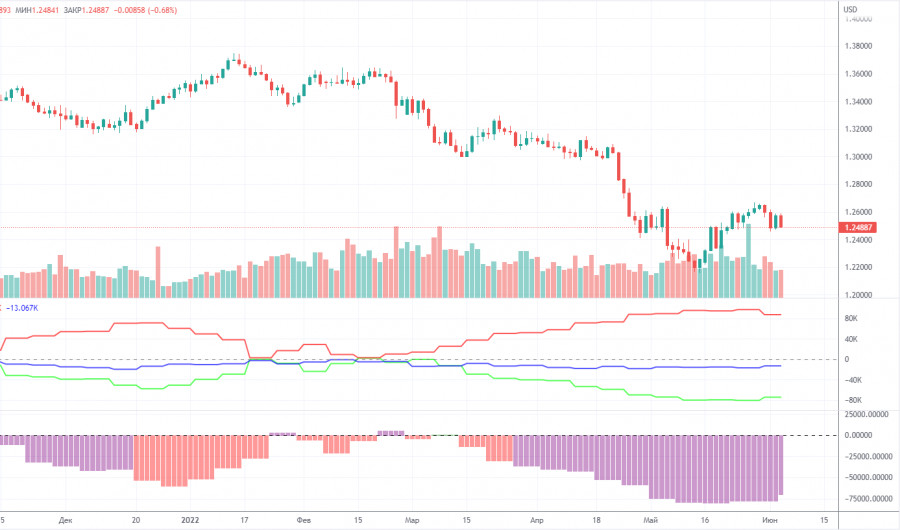

COT report:

The latest Commitment of Traders (COT) report on the British pound showed minimal changes. During the week, the non-commercial group opened 4,800 long positions and closed 1,400 short positions. Thus, the net position of non-commercial traders increased by 6,200, for the first time in a long time. The net position has been falling for three months, which is perfectly visualized by the green line of the first indicator in the chart above or the histogram of the second indicator. Therefore, one increase in this indicator is unlikely to unambiguously indicate the end of the downward trend for the pound. The non-commercial group has already opened a total of 105,000 shorts and only 31,000 longs. Thus, the difference between these numbers is already more than three times. This means that the mood among professional traders now remains "pronounced bearish". We note that in the case of the pound, the COT data very accurately reflects what is happening in the market: the mood of traders is "very bearish", and the pound has been falling against the US dollar for a long time. In the past few weeks, the pound has shown growth, but even in the chart for this paragraph (daily timeframe), this movement looks very weak. Since in the case of the pound, the COT report reflects the real picture of things, we note that a strong divergence of the red and green lines of the first indicator often means the end of the trend. Therefore, formally now we can count on a new upward trend. However, weak geopolitical, fundamental and macroeconomic backgrounds for European currencies may again put pressure on them.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. June 10. Expected and predictable: The ECB did not raise the rate, but gave hope to traders.

Overview of the GBP/USD pair. June 10. The central banks of the world synchronously missed inflation and are now reaping the benefits.

Forecast and trading signals for EUR/USD on June 10. Detailed analysis of the movement of the pair and trading transactions.

GBP/USD 1H

The pair is already definitely trading in the "swing" mode on the hourly timeframe, which leads to forming false signals, and the lines of the Ichimoku indicator lost their strength. Therefore, you should be very careful when opening any positions. It is best to work out the most accurate and strong signals - preferably for a rebound from levels of 1.2458 and 1.2589. Today, we distinguish the following important levels: 1.2259, 1.2429, 1.2458, 1.2589, 1.2659. Senkou Span B (1.2562) and Kijun-Sen (1.2513) can also be sources of signals. Signals can be "rebounds" and "breakthroughs" of these levels and lines. It is recommended to set the Stop Loss to breakeven when the price passes in the right direction by 20 points. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. There are also support and resistance levels on the chart that can be used to take profits on transactions. Nothing interesting is planned for Friday in the UK. An inflation report will be released in America, but it will provoke a reaction from traders only if its actual value is very different from the forecast. We can see good volatility, but the pair will most likely remain inside the horizontal channel.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.