Analyzing Wednesday's Trades:

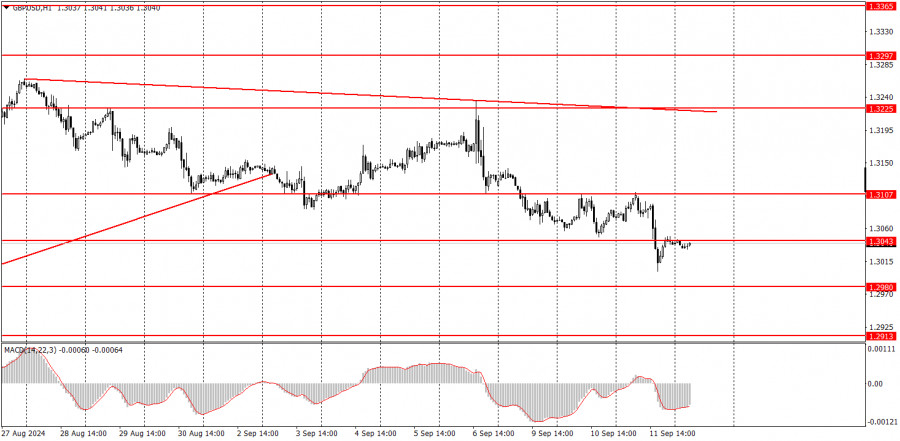

GBP/USD on 1H Chart

On Wednesday, the GBP/USD pair sustained its decline, albeit modest, but a decline nonetheless. And for those who don't remember, a decline in the British currency has been very rare in 2024, especially when U.S. macroeconomic data aren't supporting the dollar. We can't recall the last time the dollar grew on weak data. However, we have repeatedly warned that the market, for at least the entire year of 2024 (if not longer), has been primarily factoring in the future easing of the Federal Reserve's monetary policy, ignoring all other factors. Sooner or later, the moment had to come when the market fully priced in all the future rate cuts. After that, the dollar would have no reason to continue falling. We're not saying that moment has arrived, but the probability of it exists. If so, the dollar may now enter a prolonged period of strengthening. The British reports on Wednesday, much like those on Tuesday, had virtually no impact on the pair's movement.

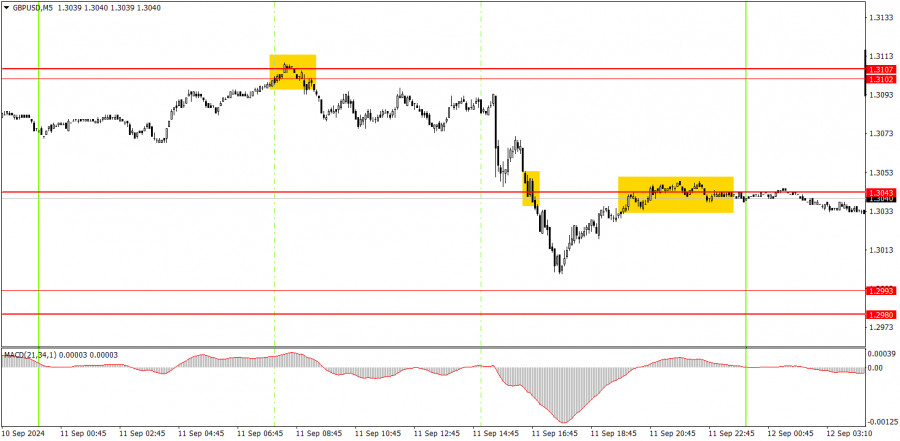

GBP/USD on 5M Chart

Several good signals were generated in the 5-minute time frame on Wednesday. At the beginning of the European trading session, the price bounced off the 1.3102-1.3107 area, then dropped to the 1.3043 level, broke through it, and narrowly missed the 1.2993 level. Thus, novice traders had reasons to open short positions in the morning. They could have closed them during the U.S. session at any time, as they would have yielded profits.

How to Trade on Thursday:

In the hourly time frame, GBP/USD has a good chance of resuming the global downtrend or at least seeing a significant correction. The British pound remains overbought, the dollar is undervalued, and the market is still much more inclined to sell dollars than to buy them. So far, the pound only shows a minor bearish correction. It is too early to speak of a full-fledged downtrend. The much-anticipated Fed meeting will take place next week, and after that, conclusions can be made regarding the medium-term direction of the dollar.

On Thursday, the pair may sustain its decline if it manages to stay below the 1.3043 level.

The key levels to consider on the 5M time frame are 1.2605-1.2633, 1.2684-1.2693, 1.2748, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3145-1.3167, 1.3225, 1.3272, 1.3310. No significant events are scheduled in the UK for Thursday, but we clearly saw that British data on Tuesday and Wednesday had virtually no impact on the pair's movement. In the U.S., the Producer Price Index and unemployment claims will be released, but these are secondary indicators.

Basic Rules of the Trading System:

1) The strength of a signal is determined by the time it takes for the signal to form (bounce or level breakthrough). The less time it took, the stronger the signal.

2) If two or more trades were opened around any level due to false signals, subsequent signals from that level should be ignored.

3) In a flat market, any currency pair can form multiple false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trades should be opened between the start of the European session and midway through the U.S. session. After this period, all trades must be closed manually.

5) In the hourly time frame, trades based on MACD signals are only advisable amidst good volatility and a trend confirmed by a trendline or trend channel.

6) If two levels are too close to each other (5 to 20 pips), they should be considered a support or resistance area.

7) After moving 20 pips in the intended direction, the Stop Loss should be set to break even.

What's on the Charts:

Support and Resistance price levels: targets for opening long or short positions. You can place Take Profit levels around them.

Red lines: channels or trend lines that depict the current trend and indicate the preferred trading direction.

The MACD indicator (14,22,3): encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a source of signals.

Important speeches and reports (always noted in the news calendar) can profoundly influence the movement of a currency pair. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to avoid sharp price reversals against the prevailing movement.

For beginners, it's important to remember that not every trade will yield profit. Developing a clear strategy and effective money management is key to success in trading over the long term.