GBP/USD

Analysis:

The upward wave of the British pound chart, which started in October last year, has entered its final phase of formation. Since the middle of last week, the pair's quotes have been surging upwards, breaking through the intermediate resistance zone. The calculated resistance is at the lower edge of a strong potential reversal zone on the weekly timeframe.

Forecast:

During the upcoming week, the British pound market is expected to be dominated by a bullish movement. In the first few days, a sideways flat or a decline to the calculated support boundaries is not excluded. The highest volatility can be expected towards the end of the week.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Sales: possible within intraday, but carry a high degree of risk.

Purchases: after confirmed reversal signals appear in the support zone area, can be used for trades.

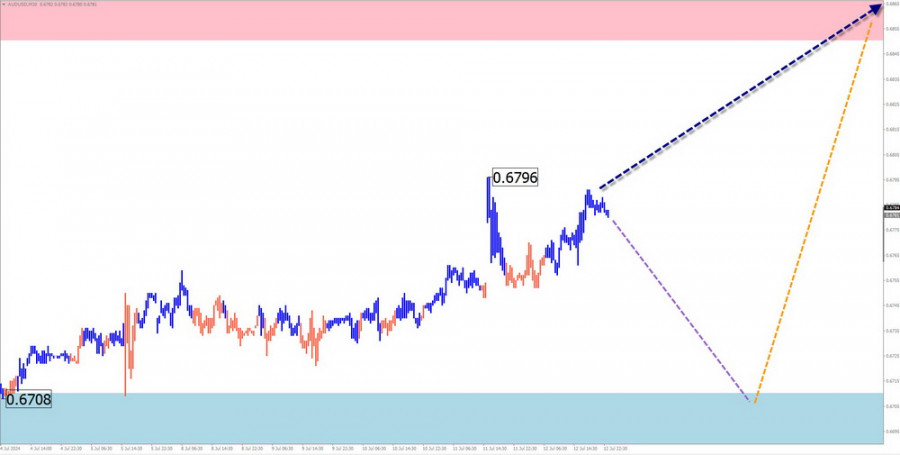

AUD/USD

Analysis:

The currently unfinished wave is correcting the dominant bearish trend of the Australian dollar chart. It started on April 19. After breaking through the intermediate resistance, the final part of the price movement began to develop. The calculated resistance marks the lower boundary of the preliminary target zone of the current wave.

Forecast:

In the coming week, an overall bullish movement vector is expected. In the first half, a brief decline down to the calculated support boundaries cannot be ruled out. After contact with this zone, a reversal formation can be expected, followed by a resumption of the bullish course of movement.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Purchases: Premature until confirmed signals of a course change appear in the support area.

Sales: Can be used for fractional volume trading. The potential is limited by support.

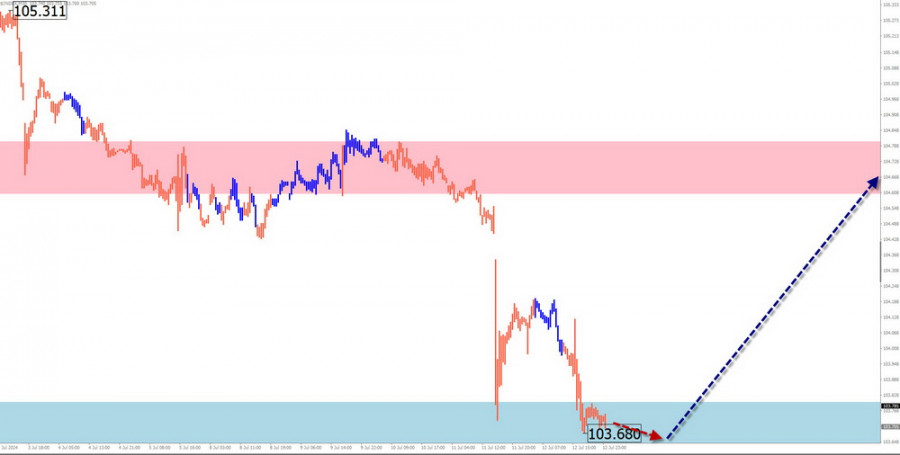

USD/CHF

Analysis:

The uptrend of the Swiss Franc major that started in December last year set a new vector for the major's quotes. In the wave structure, a corrective part (B) has been forming over the past two months. The price is approaching the upper boundary of a strong support zone on the weekly timeframe.

Forecast:

At the beginning of the upcoming week, a continuation of the flat movement is expected. A brief price rebound to the resistance area is not excluded. Then, a reversal formation and resumption of the bearish course can be expected. The highest activity is likely towards the end of the week.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Purchases: High risk, limited potential.

Sales: Can be used for trading after confirmed signals appear.

EUR/JPY

Analysis:

The four-year uptrend of the euro/Japanese yen cross has brought the pair's quotes to peak record levels. The unfinished section of the trend has been developing since the beginning of May. From the lower boundary of the wide potential reversal zone on the weekly scale, the price reversed last week. The resulting counter-movement remains within the final part of the correction.

Forecast:

Throughout the weekly period, a continuation of the overall sideways movement is expected. In the coming days, the most likely scenario is the completion of the downward course around the calculated support. Closer to the weekend, a reversal and resumption of the upward price movement can be expected.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Sales: Possible within individual trading sessions. It's safer to close trades at the first signs of a reversal.

Purchases: Will become relevant after confirmed signals appear in the support zone area.

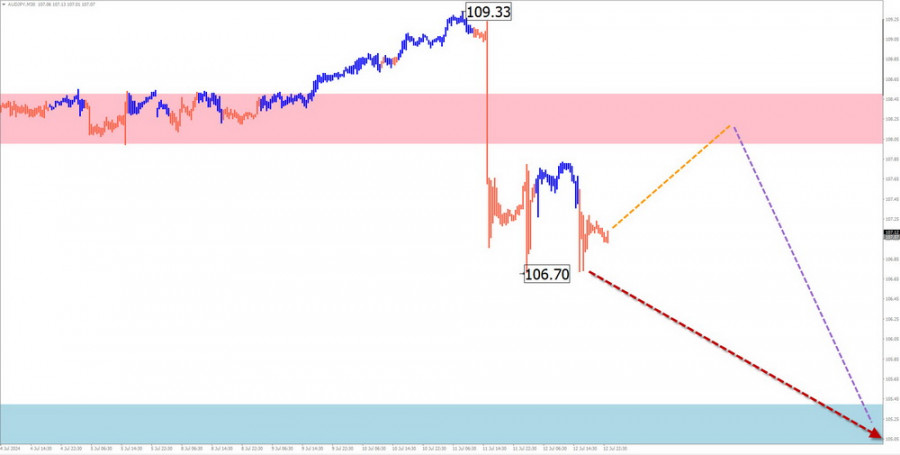

AUD/JPY

Analysis:

The unfinished upward wave of the Australian Dollar/Japanese Yen cross has brought the pair's quotes within the broad potential reversal zone on the weekly scale of the chart. From the strong resistance, the quotes started to pull back down last week. This movement remains within the final part of an irregular correction.

Forecast:

In the upcoming week, the pair is expected to continue moving downward until the current decline is fully completed around the support area. In the next couple of days, a brief upward pullback to the resistance area cannot be ruled out. Towards the weekend, increased volatility and a resumption of the downward price movement are likely.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Purchases: Possible within individual trading sessions. It is safer to close trades at the first signs of a reversal.

Sales: This will become relevant after confirmed signals appear in the resistance zone area.

US Dollar Index

Analysis:

The correction of the main wave of the North American Dollar Index has brought the quotes to a wide potential reversal zone on the weekly timeframe. The structure of this wave looks complete. The wave level of the bullish segment of the chart from July 11 has reversal potential.

Forecast:

This week, a change in the direction of the index's fluctuations is expected. After likely sideways movement in the first few days, a vector change and resumption of the rise can be expected. Growth towards the boundary level can be anticipated closer to the weekend.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

The period of weakening positions of the US dollar is nearing its end. In the upcoming week, it is advisable to close all long positions on national currencies and start looking for opportunities to sell them in major pairs.