Bitcoin spent the weekend in relative stability and did not leave the $15.7k–$17.2k range. However, the price consolidation took place with a slight bearish dominance, which led to a breakdown of the key support area of $16.2k on Sunday.

Over the past 24 hours, the main cryptocurrency has fallen 2.5% and is trading near the $16k psychological support level. Bitcoin is close to the retest of the local bottom at $15.7k, which is fraught with another wave of capitulation.

Fundamental problems in the market

It is important to emphasize that investors continue to digest the collapse of FTX. Genesis and Gemini are reporting withdrawal suspensions due to liquidity issues. Binance is considering a buyout of companies, but this does not inspire optimism in the market.

Another worrisome wave swept the crypto market after Grayscale, the largest Bitcoin trust, refused to publish reports on its reserves. There have been rumors that the company is also experiencing financial difficulties due to the collapse of FTX and the update of Bitcoin's local bottom.

Grayscale shares are trading 43% below the current value of BTC as of November 21, but the market is in no hurry to buy at discounts. This confirms the undermined confidence of institutional investors in the cryptocurrency market.

In addition, Grayscale affiliate DCG lost large amounts of money during the collapse of LUNA and now FTX. Despite this, there is no clear evidence of Grayscale's problems, but given the realities, this is enough for investors to lose interest in digital assets.

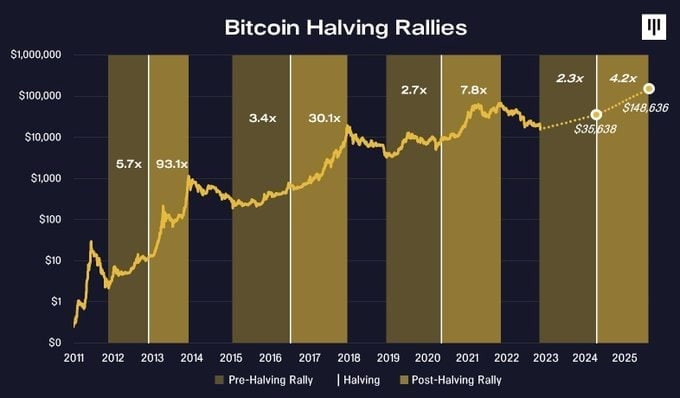

At the same time, Panter Capital reported that the fund bought $137 million worth of Bitcoins. The deal was attended by 141 investors with a minimum investment of $50,000. The fund believes that by 2024, Bitcoin will resume its bullish rally after halving and set a new value record.

In addition to fundamental factors, the main cryptocurrency continues to be under pressure from miners. After the next recalculation of the complexity of BTC mining, the indicator increased by 0.51% and is near the maximum levels.

For miners, this is a wake-up call, as the cost of mining cryptocurrencies is rising, while income remains low or even falling. Miners have sold 135% of their holdings over the past week, according to Glassnode reporting. This means that Bitcoin mining companies sell at least 315 BTC daily.

IntoTheBlock also informs that Bitcoin finally broke the correlation with stock indices due to the collapse of FTX. As of Nov. 21, the BTC–SPX correlation has fallen to -0.58, according to the analytical publication. This means that the cryptocurrency goes free-floating without (conditional) support/benchmark in the form of the stock market.

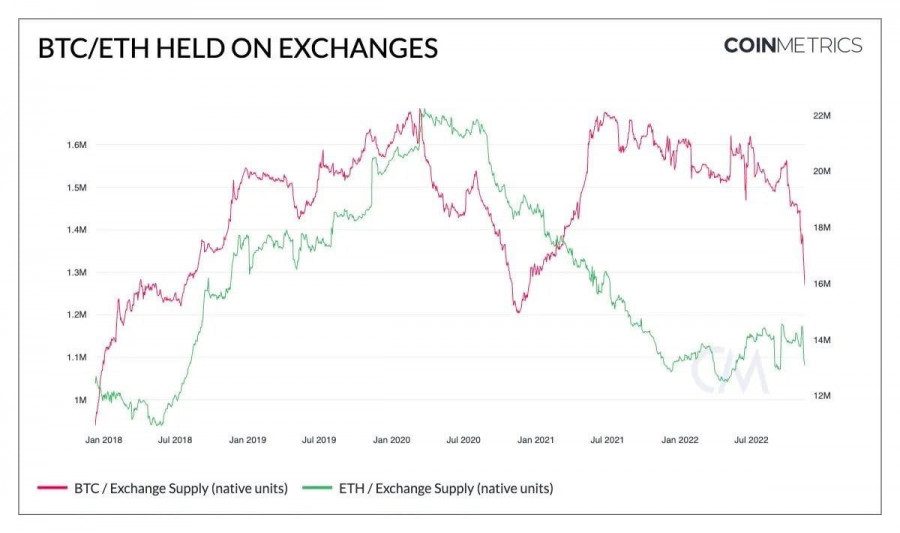

CoinMetrics also reports that over the past week, investors have withdrawn more than 120,000 BTC and 1.4 million ETH from exchanges. It is important to note that far from 100% of these volumes are redirected to cold wallets. Part of the reserves of BTC and ETH are being sold and putting pressure on the price of cryptocurrencies.

BTC/USD Analysis

On the daily chart of the cryptocurrency, the price is still being pressed into the "triangle" figure. Decreased volatility and trading volumes confirm investors' wait-and-see attitude. The publication of Fed's plans for further monetary policy will likely become a catalyst for the BTC price to move out of the $15.7k–$17.2k range.

Technical indicators of the cryptocurrency also point to the preservation of the sideways trend in the next few days. At the same time, we should expect a systematic decrease in the price of BTC to the support area of $15.7k–$15.9k. If buyers manage to protect this boundary, the price will go to the range of $16.7k–$17k.

Results

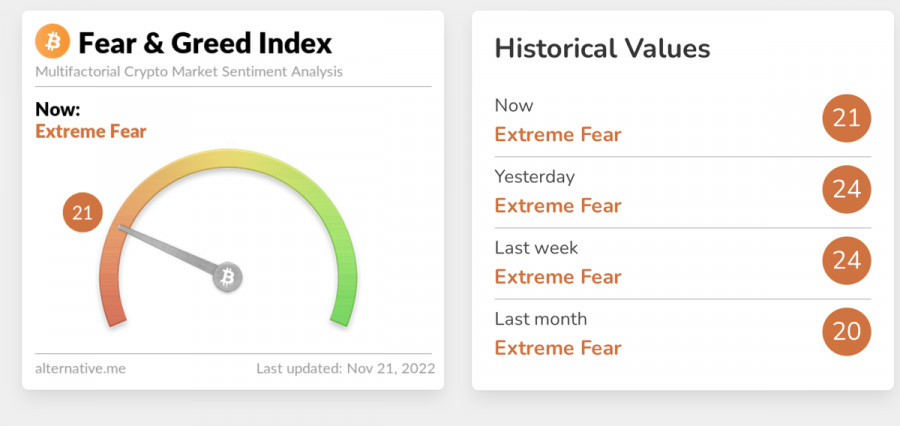

Market sentiment remains tense, and the aftertaste of the FTX bankruptcy continues to weigh on investors. The psychological state of the players also indicates that the point of no return has been reached.

On the one hand, the price of BTC has fallen quite low, but on the other hand, the collapse of FTX stops investors from buying off the bottom and makes them expect a further fall. Given these factors, we should expect the final decline of BTC below $15k in the next two weeks of November.

The obvious and the first signal to reach the bottom will be the formation of a V-shaped fall, followed by a rapid buyout. Until then, BTC will continue to consolidate within $15.7k–$17.2k and wait for the right moment to break out of the range.